how much federal income tax comes out of paycheck

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. The current rate for Medicare is 145 for the employer and 145 for.

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

The federal government collects your income tax payments.

. How to calculate Federal Tax based on your Weekly Income. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. What is the percentage that is taken out of a paycheck.

How It Works. A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck. Use this tool to.

How much federal tax is taken out of your paycheck will also be determined by your tax bracket the more income you earn the higher percentage tax bracket you might move. Taxes Taken Out Of Paycheck Everything You Need To Know from. For a single filer the first 9875 you earn is taxed at 10.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The amount withheld per paycheck. Federal income taxes are paid in tiers.

See how your refund take-home pay or tax due are affected by withholding amount. There are eight tax brackets that vary based on income level and filing status. Your employer withholds a 62 Social.

Estimate your federal income tax withholding. The social security and medicare taxes come to 7650 for a total of 29650. Wealthier individuals pay higher tax rates than lower-income individuals.

To do a Paycheck Checkup to make sure they have the right amount of. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and. NJ Taxation Effective January 1 2020 the tax rate on that income bracket increases from 897 to 1075 regardless of filing status.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Income over 5 million is already. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

The state tax year is also 12 months but it differs from state to state. You pay the tax on only the first 147000 of. Some states follow the federal tax year some.

New Yorks income tax rates. See where that hard-earned money goes - Federal Income Tax Social Security and. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Paycheck Calculator What Is My Take Home Pay After Taxes In 2019

Federal Income Tax Withholding Employer Guidelines And More

Take Home Paycheck Calculator Hourly Salary After Taxes

Us States Where The Most Taxes Are Taken Out Of Every Paycheck

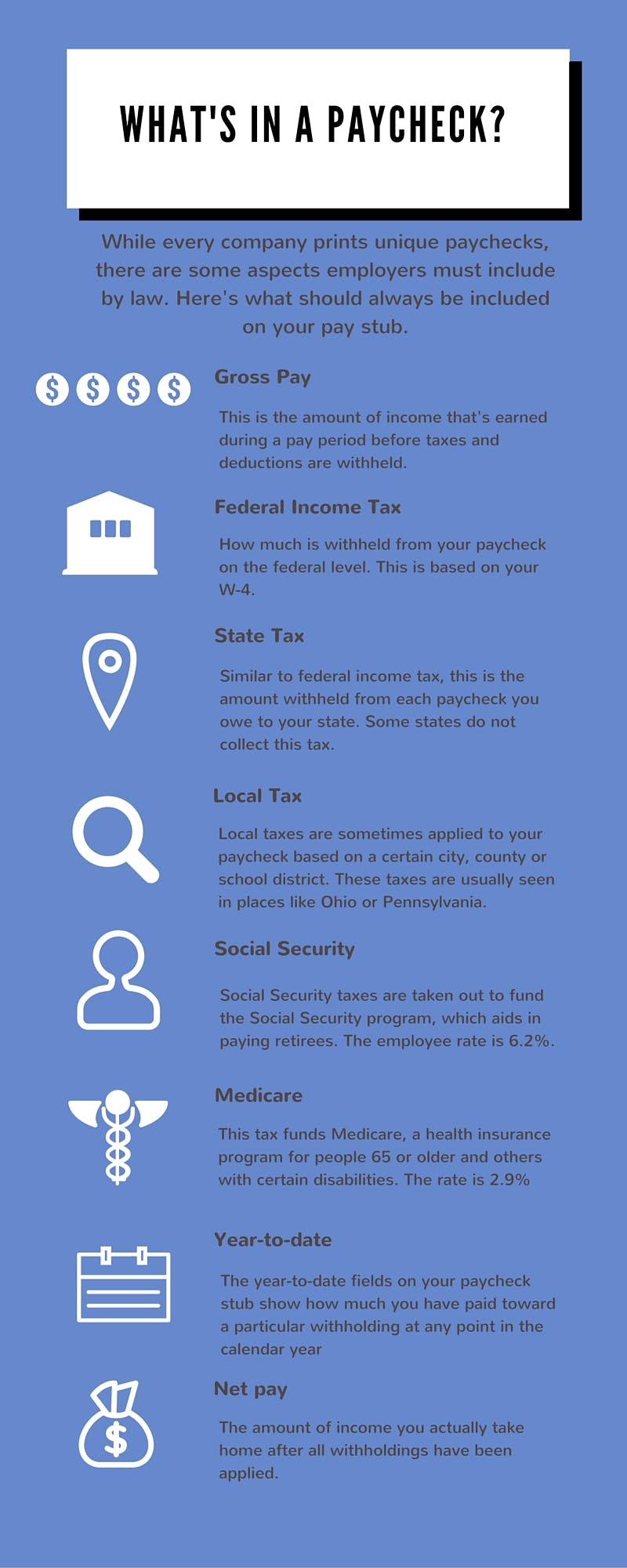

What Is Included In A Basic Paycheck Infographic Paycheckcity

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

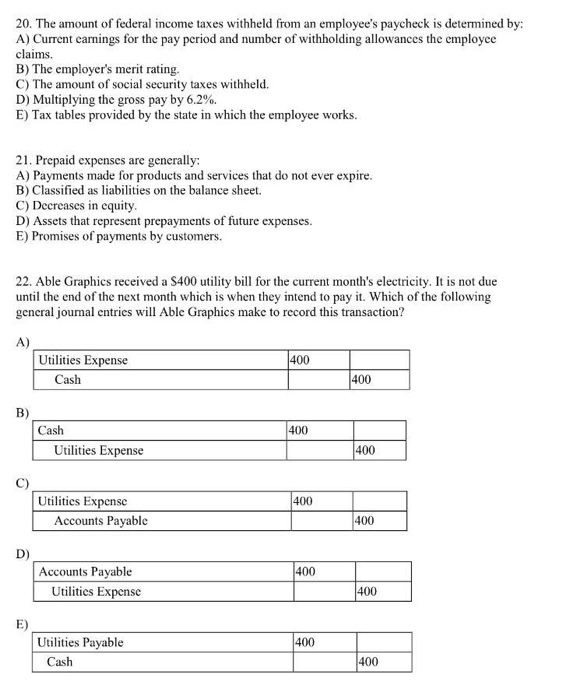

Solved 20 The Amount Of Federal Income Taxes Withheld From Chegg Com

Explaining Paychecks To Your Employees

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

How Much Of My Paycheck Goes To Taxes

New Tax Law Take Home Pay Calculator For 75 000 Salary

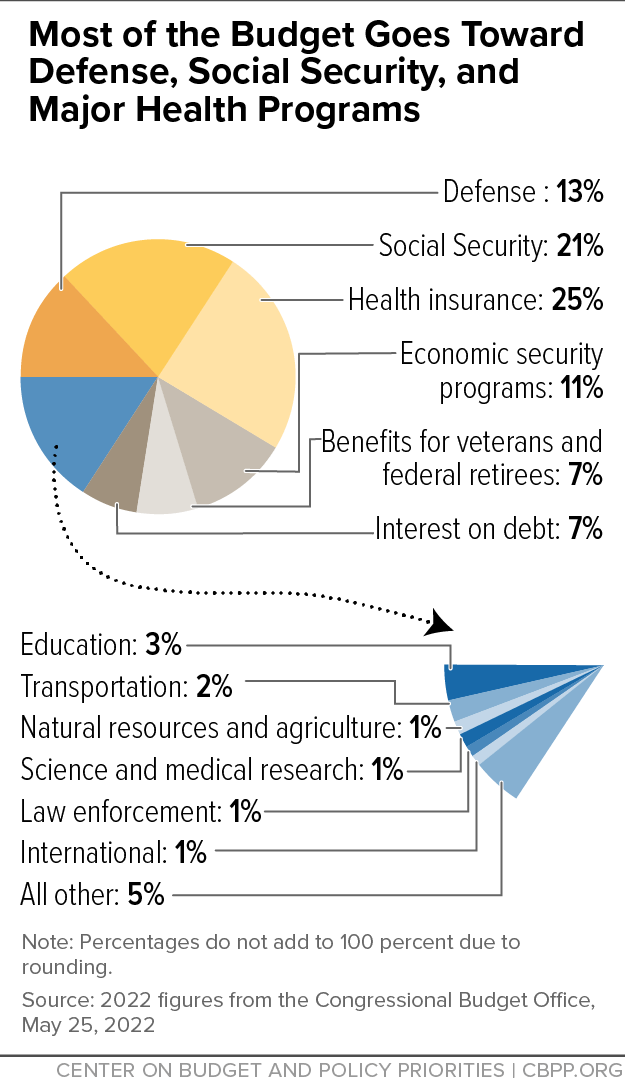

Policy Basics Where Do Our Federal Tax Dollars Go Center On Budget And Policy Priorities

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

New Tax Law Take Home Pay Calculator For 75 000 Salary